In the world we live in, having an understanding of finances is crucial for achieving success. Educating kids about how to handle money and make decisions from a young age prepares them for making wise choices with their finances throughout their lives. Luckily, there are plenty of interactive ways to teach these skills, with board games standing out as one of the most effective approaches.

Playing board games is a fun and interactive way for kids to learn about money management. In this piece, we’ll delve into some board games that aim to teach literacy to children, combining education with entertainment. Let’s dive into the world of board games that help kids understand finances better.

Playing board games is a fun and interactive way for kids to learn about money management. In this piece, we’ll delve into some board games that aim to teach literacy to children, combining education with entertainment. Let’s dive into the world of board games that help kids understand finances better.

Monopoly is a fun game and a valuable tool for teaching financial literacy. You can also play the game with alternative rules to speed it up or make it more fun. Here are some critical points in financial literacy that Monopoly covers:

Monopoly is a fun game and a valuable tool for teaching financial literacy. You can also play the game with alternative rules to speed it up or make it more fun. Here are some critical points in financial literacy that Monopoly covers:

Life is a classic board game in which players simulate a journey through life, from college to retirement, experiencing various milestones and events along the way. This game was initially released in 1960 and has certainly passed the test of time. It’s meant for 2 to 6 players and usually lasts about 1 to 2 hours. The player with the most assets upon retirement is crowned the champion.

The Life game covers several key points in financial literacy:

Life is a classic board game in which players simulate a journey through life, from college to retirement, experiencing various milestones and events along the way. This game was initially released in 1960 and has certainly passed the test of time. It’s meant for 2 to 6 players and usually lasts about 1 to 2 hours. The player with the most assets upon retirement is crowned the champion.

The Life game covers several key points in financial literacy:

The main goal of Payday is to gather the money by the game’s conclusion. Players can accomplish this by earning income, handling expenses, and making choices during the month. Payday touches on aspects of knowledge, allowing players to interact with different elements of personal finance enjoyably and engagingly. Here are some critical financial literacy points that the game addresses:

The main goal of Payday is to gather the money by the game’s conclusion. Players can accomplish this by earning income, handling expenses, and making choices during the month. Payday touches on aspects of knowledge, allowing players to interact with different elements of personal finance enjoyably and engagingly. Here are some critical financial literacy points that the game addresses:

Table of Contents

Toggle1. Monopoly

Monopoly, a timeless board game, stands out as one of the choices for players looking to grasp money management skills through the generations. With a player count ranging from 2 to 8, the game centers on acquiring, selling, and exchanging properties to secure the participant’s title. As players traverse the board engaging in property transactions and monetary dealings, they must employ thinking to outwit their rivals. Through its gameplay mechanics, Monopoly imparts lessons in budgeting, negotiation tactics, and risk assessment, rendering it an ideal choice for individuals of all ages seeking to enhance their money-handling abilities. This is a classic game that holds dear to my heart, and it brings me back to some fond family memories. Monopoly first hit stores in 1935 and is still being sold. There are now video game versions of this board game on different platforms, which are doing very well.- Budgeting: Players must manage their money wisely throughout the game, budgeting for property purchases, rent payments, taxes, and other expenses. This teaches the importance of budgeting and living within one’s means.

- Investing: Monopoly encourages players to invest in properties strategically to generate rental income. Players must assess the potential value of properties and make informed investment decisions, teaching basic investing principles.

- Risk Management: Players must weigh the risks and rewards of various decisions, such as whether to invest in additional properties, build houses and hotels, or hold onto cash reserves. This teaches the importance of risk management in financial planning.

- Debt Management: Monopoly introduces the concept of borrowing and debt through the option to mortgage properties for cash. Players must carefully consider when to use this option and understand the consequences of carrying debt, such as paying interest.

- Income Generation: Monopoly emphasizes the importance of generating passive income through property ownership. Players learn to leverage assets to create ongoing income streams, a fundamental concept in building wealth.

- Negotiation and Communication: Monopoly involves negotiation and communication skills as players trade properties, make deals, and form alliances with other players. These interpersonal skills are essential in real-life financial transactions and negotiations.

- Patience and Long-Term Planning: Monopoly teaches patience and the value of long-term planning. Success in the game often requires a strategic approach, with players focusing on long-term objectives rather than short-term gains.

- Economic Concepts: Monopoly introduces players to various economic concepts, such as supply and demand, competition, monopolies, and market dynamics. Understanding these concepts can help players make better financial decisions in real life.

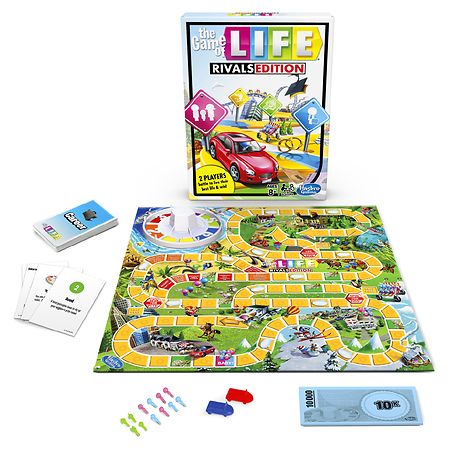

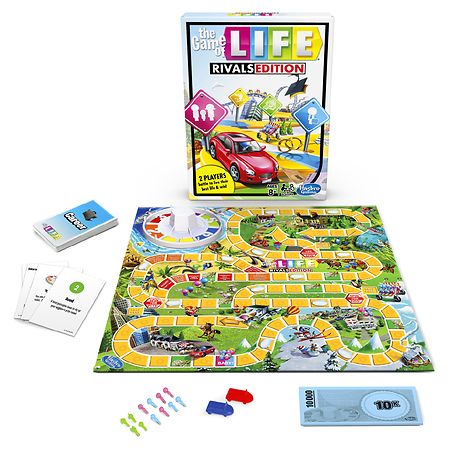

2. The Game of Life

The Game of Life takes players around the board, navigating the twists and turns of life’s ups and downs. Throughout the journey, players face choices like selecting a profession, purchasing real estate, and beginning a family. The game teaches the significance of preparing for tomorrow, handling costs, and making financial moves. The main goal of Life is to amass wealth and achieve retirement with value. With its blend of luck and strategy, The Game of Life offers valuable financial management and personal finance lessons. Life is a classic board game in which players simulate a journey through life, from college to retirement, experiencing various milestones and events along the way. This game was initially released in 1960 and has certainly passed the test of time. It’s meant for 2 to 6 players and usually lasts about 1 to 2 hours. The player with the most assets upon retirement is crowned the champion.

The Life game covers several key points in financial literacy:

Life is a classic board game in which players simulate a journey through life, from college to retirement, experiencing various milestones and events along the way. This game was initially released in 1960 and has certainly passed the test of time. It’s meant for 2 to 6 players and usually lasts about 1 to 2 hours. The player with the most assets upon retirement is crowned the champion.

The Life game covers several key points in financial literacy:

- Budgeting: Players must manage their finances throughout the game, balancing expenses such as home buying, paying taxes, and raising a family with income from their chosen career.

- Investment: The game includes opportunities for players to invest in properties that can provide passive income. This teaches players about investing and the potential benefits of owning assets.

- Risk Management: Players must navigate various life events, some of which involve financial risk, such as choosing a career with a high salary but also high risks or deciding whether to take out insurance for potential losses.

- Income Generation: The game emphasizes the importance of earning income through a chosen career. Players receive a salary each time they pass the payday space, highlighting the need for a steady income stream to support their lifestyle.

- Savings: Players must save money to achieve their goals, whether buying a house, paying for their children’s education, or saving for retirement. This teaches the importance of saving and planning for the future.

- Debt Management: The game includes loans and mortgages, where players may need to borrow money to purchase assets like a home. This introduces the concept of debt and the need to manage it responsibly.

- Insurance: Players can purchase insurance in the game to protect against unforeseen events such as accidents or lawsuits. This highlights the importance of risk management and having appropriate insurance coverage.

- Retirement Planning: The game culminates in retirement, where players calculate their net worth based on their accumulated assets and Life Tiles. This encourages players to plan and save for retirement throughout their journey.

3. Payday

Payday is a board game designed for 2- 4 players, where participants handle their finances throughout a month, covering expenses, exploring investment opportunities, and handling costs. This game teaches budgeting, saving, and preparing for what lies within the backdrop of financial highs and lows. Through its money situations and easy-to-follow gameplay, Payday serves as a tool to educate children on the importance of managing their finances responsibly.- Budgeting: Payday emphasizes the importance of budgeting by requiring players to manage their income and expenses throughout the month. Players must prioritize essential expenses while considering investment opportunities and generating additional revenue.

- Income Management: The game introduces players to different sources of income, such as salaries from career cards, payday spaces on the board, and deals from Deal cards. Players learn to balance multiple income streams and maximize their earning potential.

- Expense Management: Payday highlights the need to manage expenses effectively, including bills, taxes, and other financial obligations. Players must navigate unexpected expenses and make strategic decisions to minimize costs and maximize wealth.

- Debt Management: The game allows players to take out loans from the bank to cover expenses or invest in opportunities. Players learn about the implications of borrowing money, including interest rates and repayment schedules, and the importance of managing debt responsibly.

- Investing: Payday introduces players to various investment opportunities, such as buying and selling goods, investing in stocks, and pursuing other financial transactions through Deal cards. Players learn about the potential risks and rewards of investing and how to make informed decisions to grow their wealth.

- Risk Management: Players encounter unexpected events and challenges throughout the game, such as losing money on a bad deal or facing unexpected expenses. Payday teaches players the importance of risk management and strategic decisions to mitigate potential losses.

- Savings and Planning: The game motivates players to save money and prepare for the future by deciding how to distribute their earnings and assets. Players gain insight into the advantages of saving for events and future objectives, like retirement.

- Financial Decision-Making: Payday requires players to make various financial decisions throughout the game, from budgeting and investing to managing debt and navigating unexpected events. Players develop critical thinking skills and learn to evaluate different options and their potential outcomes.

4. Money Bags

Money Bags is a fun and educational game in which players collect money bags’ coin value as they move around the board and build wealth. The game teaches basic money skills such as counting, addition, and subtraction, making it ideal for younger children. With its colorful game board, 2-4 players, and simple rules, Money Bags is an excellent game for teaching kids about money’s value and how to responsibly manage their finances.5. The Allowance Game

The Allowance Game is a board game set in a virtual town where players earn money by completing chores and tasks. Players must then decide how to spend or save their money, teaching valuable budgeting and financial planning lessons. The game also introduces concepts such as interest, taxes, and entrepreneurship, helping kids to learn about the broader aspects of personal finance in a fun and engaging way.The key points in financial literacy the game covers are:

- Budgeting: Encourage players to budget their money wisely to ensure they have enough funds to cover expenses while also saving towards the winning goal.

- Risk Management: Assess the potential risks and rewards of different financial decisions, such as saving money versus spending it on immediate desires.

- Strategic Movement: Players may strategically choose their path on the board to maximize their earnings or minimize their expenses.

6. Cashflow for Kids

Cashflow for Kids is a junior version of the popular Cashflow 101 game created by renowned financial educator Robert Kiyosaki. In this game, players move around the board collecting money at the end of each turn, simulating real-life financial management and cash flow. The game teaches players about assets, liabilities, income, and expenses in a fun and educational way. By making wise financial decisions throughout the game, kids learn to make intelligent decisions that can lead to financial freedom later in life.

The game continues until one player accumulates enough passive income to cover their expenses, effectively escaping the rat race. This player wins the game. The winning factor of the game tells you that this game, directly and indirectly, has financial literacy as a big part of the game. The game is for 2-6 players, and here is some of the economic knowledge your child may learn while playing.

The game is usually enjoyed by 2 to 4 players and lasts 30 to 45 minutes. The winner is the player who reaches $10,000 and returns to the board’s starting point. Below are some concepts covered in the game.

The game is usually enjoyed by 2 to 4 players and lasts 30 to 45 minutes. The winner is the player who reaches $10,000 and returns to the board’s starting point. Below are some concepts covered in the game.

The Entrepreneur Game can be played by 2 to 6 players aiming to amass wealth through property acquisition, business management, and strategic investments. Participants seek to grow their worth by making financial choices and outwitting their rivals. The game usually ends when a player reaches a wealth target. The player, with the cost when the game concludes, emerges as the victor. Below are some concepts addressed in the game:

The Entrepreneur Game can be played by 2 to 6 players aiming to amass wealth through property acquisition, business management, and strategic investments. Participants seek to grow their worth by making financial choices and outwitting their rivals. The game usually ends when a player reaches a wealth target. The player, with the cost when the game concludes, emerges as the victor. Below are some concepts addressed in the game:

The primary objective of The Stock Market Game is to accumulate the most wealth by strategically investing in stocks and managing your portfolio effectively. The game typically ends after a set number of rounds, and the player with the highest accumulated wealth (cash plus the value of their stock investments) is declared the winner. Here is the financial knowledge the game teaches:

The primary objective of The Stock Market Game is to accumulate the most wealth by strategically investing in stocks and managing your portfolio effectively. The game typically ends after a set number of rounds, and the player with the highest accumulated wealth (cash plus the value of their stock investments) is declared the winner. Here is the financial knowledge the game teaches:

- Assets: Encourage players to prioritize acquiring assets that generate passive income, such as businesses, real estate, or stocks.

- Manage Expenses: Teach players to minimize expenses and avoid liabilities that drain their cash flow.

- Diversify Investments: Encourage players to diversify their investment portfolio to reduce risk and maximize returns.

7. Moneywise Kids

Moneywise Kids is an educational board game designed to teach children about personal finance in a fun and interactive way. In Moneywise Kids, players step into the shoes of adults facing the hurdles of handling their money, from covering expenses to setting aside savings for what lies. The game educates on budgeting, banking, and investing, empowering youngsters to hone skills while having fun. Featuring a game board and interactive gameplay, Moneywise Kids is a tool to equip kids with the financial know-how needed for adulthood’s fiscal duties.- Budgeting: Encourage players to budget their money wisely, balancing income, expenses, and savings.

- Investing: Teach players about the benefits of investing money to earn passive income over time.

- Risk Management: Help players understand the importance of managing unexpected expenses and planning for emergencies.

- Long-Term Planning: Encourage players to think about long-term financial goals and strategies for achieving them.

Moneywise Kids provides a fun and engaging way for children to learn essential financial skills while playing a board game. By simulating real-world financial scenarios, players can develop a better understanding of money management and financial decision-making.

8. The Entrepreneur Game

The Entrepreneur Game is a board game that teaches entrepreneurship and business skills to players of all ages. Players in this game embark on the journey of launching and expanding their companies, encountering both obstacles and chances for growth. By delving into product development and marketing tactics, players gain insights into the facets of a thriving business, all while handling finances and making choices. The Entrepreneur Game, with its emphasis on entrepreneurship, serves as a resource that introduces young individuals to the realms of business and finance.- Diversification: Investing in a variety of properties and businesses can reduce risk and increase potential income streams.

- Strategic Development: Developing properties and businesses can increase their value and generate higher returns.

- Financial Management: Efficiently managing cash flow and investments is crucial for long-term success.

- Risk Management: Assessing risks and rewards before making investment decisions can minimize losses and maximize gains.

9. Rich Dad’s Cashflow 101

Developed by the same team behind Cashflow for Kids, Rich Dad’s Cashflow 101 is designed for older children and adults. It provides a more in-depth exploration of financial concepts such as investing, passive income, and asset management. Players navigate the board, making financial decisions to escape the “rat race” and achieve financial freedom. With its realistic scenarios and emphasis on financial education, Cashflow 101 is an excellent tool for teaching players of all ages about wealth-building principles.10. The Stock Market Game

The Stock Market Game is a game that mimics the fluctuations of the stock market. Participants buy and sell stocks to create a portfolio and aim for returns. This game imparts knowledge of investment tactics, risk assessment, and the significance of research and analysis in making decisions. By immersing players in world scenarios, The Stock Market Game is an insightful tool for introducing individuals of all ages to the realm of investments. Whether you’re new to investing and seeking knowledge or an experienced investor looking to refine your strategies, The Stock Market Game offers an enlightening way to delve into the universe of stocks and investments.- Diversification: Spreading investments across different stocks can help mitigate risk.

- Market Timing: Buying low and selling high is a fundamental strategy in the stock market. Players must pay attention to stock prices and market trends.

- Risk Management: Assessing the potential risks and rewards of each investment is crucial. Some stocks may offer high dividends but come with greater volatility.

- Information Gathering: Keeping track of market conditions, chance card effects, and other players’ actions can provide valuable insights for making informed investment decisions.

- Negotiation: Effective negotiation skills can help players strike beneficial deals during trading, potentially increasing their wealth.

The Stock Market Game offers an engaging and educational experience that combines strategy, luck, and financial management elements. Players must balance risk and reward while navigating the stock market’s dynamic fluctuations to emerge victorious.